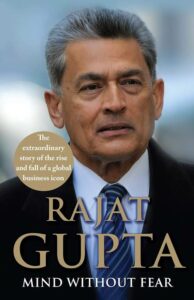

Rajat Gupta – MD of McKinsey for 9 years (3 terms, a limit set by him only), a professional on the Board of giants like Goldman Sachs, P&G, Genpact among others and holding leadership profiles at various forums such as ICC (International Chamber of Commerce), WEF (World Economic Forum), Gates Foundation to name a few. And of course, conceptualizing & delivering an institute of the stature of ISB adds another feather to his cap. A profile boasting of such brands cannot be complete without being connected to people of similar, in some cases, even higher, stature. Bill Gates, Bill Clinton, George Bush, Manmohan Singh, Sunil Bharti Mittal, Mukesh Ambani, Anil Ambani, Kiran Mazumdar Shaw as some names that give you a sense of what this man is all about. First non-white head of McKinsey was just the beginning. His was one of the biggest high profile cases for corporate professionals living in the highest echelons of capitalistic success! The way his feelings had unfolded in the events leading to his eventual sentencing are so true & there’s a lot to learn from this one.

The charge – Insider Trading for P&G and Goldman Sachs to Galleon hedge fund manager Raj Rajaratnam

Below are some of the finest takeaways from a corporate honcho who made it as big as it could possibly get (for a professional) –

Leadership

- This approach was central to my leadership capacity – expect the best from people, and they often live up to that expectation

- The problems we considered in Harvard had no right answers and could be approached by several equally valid perspectives. In analysing business cases, I learned the importance of gathering and presenting all the possible evidence before making a recommendation or decision – a practice that would serve me throughout my career

- I never played golf. Whatever advantages my colleagues may have gained on the golf course, I preferred to spend my weekend with my family. Use difference to your advantage

- The eight laws of Rajat Gupta –

- If someone else wants to do it, let him

- If you have 10 problems, ignore them – 9 will go away

- Being there is 90% of the game

- You can’t push a noodle; find the right angle and pull

- The softer you blow your own trumpet, the louder it will sound

- There is no such thing as working too much or too little time

- Listening takes a lot less energy

- When in doubt, invite them home

- Most companies, especially large, complex ones, are going to need help sooner or later. But they’ll call a consultant when ‘they’ are ready, not when ‘you’ are ready. The key is to be the first person they think of when they decide to make the call

- Any project that Needs to be done, Can be done! A famous McKinsey saying was: Up or Out!

- People believe that AIDS epidemic could not happen in a religious country like India. They saw it as a western disease and clung on to denial that casual sex was so prevalent in India. Wildly blind to reality was the Indian society & polity!

Trial

- The trial had all the makings of a media spectacle, and the last thing I needed was to play a starring role

- Throughout Raj Rajaratnam’s trial… there has been an elephant in the courtroom: Rajat K Gupta. Rajat Gupta is not being tried here nor has he been charged criminally. I was referred to in the courtroom as an “unindicted co-conspirator”

- On the appointment of Preet Bharara for his case: Bharara’s appointment had initially inspired high hopes that he would aggressively pursue charges against the banking executives responsible for the financial crises. No such charges were forthcoming and soon he became the target of pointed criticisms in the press. The public was angry and rightly so. It was a shrewd strategy: by cracking down on insider trading and aggressively prosecuting hedge fund managers and their informants, Bharara could appear to be taking a hard line on corruption without pursuing the tough cases and endangering his perfect record of convictions

- To ensure success of this strategy, do what any good politician does: hire PR people, lots of them. Reputations were destroyed long before cases reached the courtroom, and indeed many never got there

- On the Jury: It would be up to these people to decide whether I was a scheming, greedy, envious man who traded corporate secrets for access to billionaire’s circle, or an honest, trustworthy but overstretched man who made a poor choice of business associates and was guilty of no more than bad timing. My greatest concern was how many among the twelve had experience or understanding of business and finance?

- The rules of evidence, made solely by the judge, shape the narrative that the jury hears

Experience

- On not standing for re-election on the Goldman board because of lawyer driven investigation – I should’ve known it was a fallacy. Such short term expedient moves are invariably wrong moves, and it went against my commitment to honesty and transparency. The story was going to come out sooner or later, and when it did, the board members would probably think worst of me as I’d kept it from them

- Davos (WEF) gathering was always a welcome opportunity to reconnect with old friends, but this time I could see the unasked questions in too many eyes, and it was hard not to imagine that people were walking about me and speculating about the case. Mukesh Ambani and Sunil Mittal expressed their support

- I was presented my first pair of handcuffs. The cold steel against my wrists evoked a surge of rage and shame, breaking through the strange calm that had stayed with me throughout the night

- On the “sixteen second gap” (which was the time duration after a board meeting & making the call to Raj) – It was the story of a ridiculously busy, over stretched man trying to manage his personal finances ($10mn in the voyager fund), while also gifting numerous major companies and non-profits, at home and abroad, during one of the most volatile periods in our economy’s history

- Before trial began, on writing an email – Looking at their names brought up a surge of emotion. These people were what mattered to me – not money, not acclaim, not attaining some elite status, as the prosecutor was trying to suggest. My battered reputation was not an abstract idea to me – it was contained in these relationships that I’d built so carefully, over decades

- I knew that in those moments when we cannot see the reasoning behind the wins of fate, acceptance is a virtue

- On the whole, despite its dark moments, my time in prison is most memorable for the camaraderie, courage, and humanity if people I came to know

Rajat K Gupta was sentenced to 2 years in prison for securities fraud. He did not take the stand to testify for himself. This is his greatest regret! He claims he was in touch with Raj Rajaratnam to seek answers and get his money back from the fund that he had invested in with Raj. Raj had siphoned off money without his knowledge. There was no trail of any benefits due to the alleged tip offs.

No Quid pro Quo! But during times of crises, bringing down a giant is what gives the mob (who has absolutely no clue) a respite and some opportunist the much desired fame! My biggest takeaway – As you rise through the ranks and grow, for each and every action you take, caution must be exercised so as to not let your brand take the beating! The audience loves David beating Goliath every f*ckin’ time!

Do share your views/feedback in the comments section

[…] A McKinsey partner once told Forbes: “We don’t learn from clients. Their standards aren’t high enough. We learn from other McKinsey partners” (Read more about McKinsey in words of their ex-MD, Rajat Gupta, here) […]

Thank you a lot for giving everyone an exceptionally memorable opportunity to check tips from here. It is always so great and also jam-packed with a lot of fun for me and my office co-workers to search your blog no less than 3 times in one week to learn the latest items you will have. And of course, I’m also actually amazed considering the extraordinary tactics you give. Certain 1 tips in this article are undeniably the most beneficial we have had.