Fake, latest one by Robert T Kiyosaki, reiterates his belief about investment and understanding money. Money, one of the most critical things that everyone uses in life, is something that unfortunately no school teaches. The fundamental of Kiyosaki’s learning that the “Poor work for their money. The Rich make their money work for them” stays true in this one as well. Somehow he is making the case for Gold as an investment in this one, but being a true teacher that he is – He isn’t imposing that it is the ONLY correct answer!

Below is my interpretation of the book –

- The school system calls asking for help “cheating”. The business world calls it “cooperation”. This is the most fundamental difference between theory & practice!

- Without real financial education, very few people know how to take a million dollar idea and turn it into a million dollars. That is why most people do not trust start-ups

- Do we have Fake Truth? Yes. In school, it is called history. In military school; we were taught history belongs to the victors, not the losers!

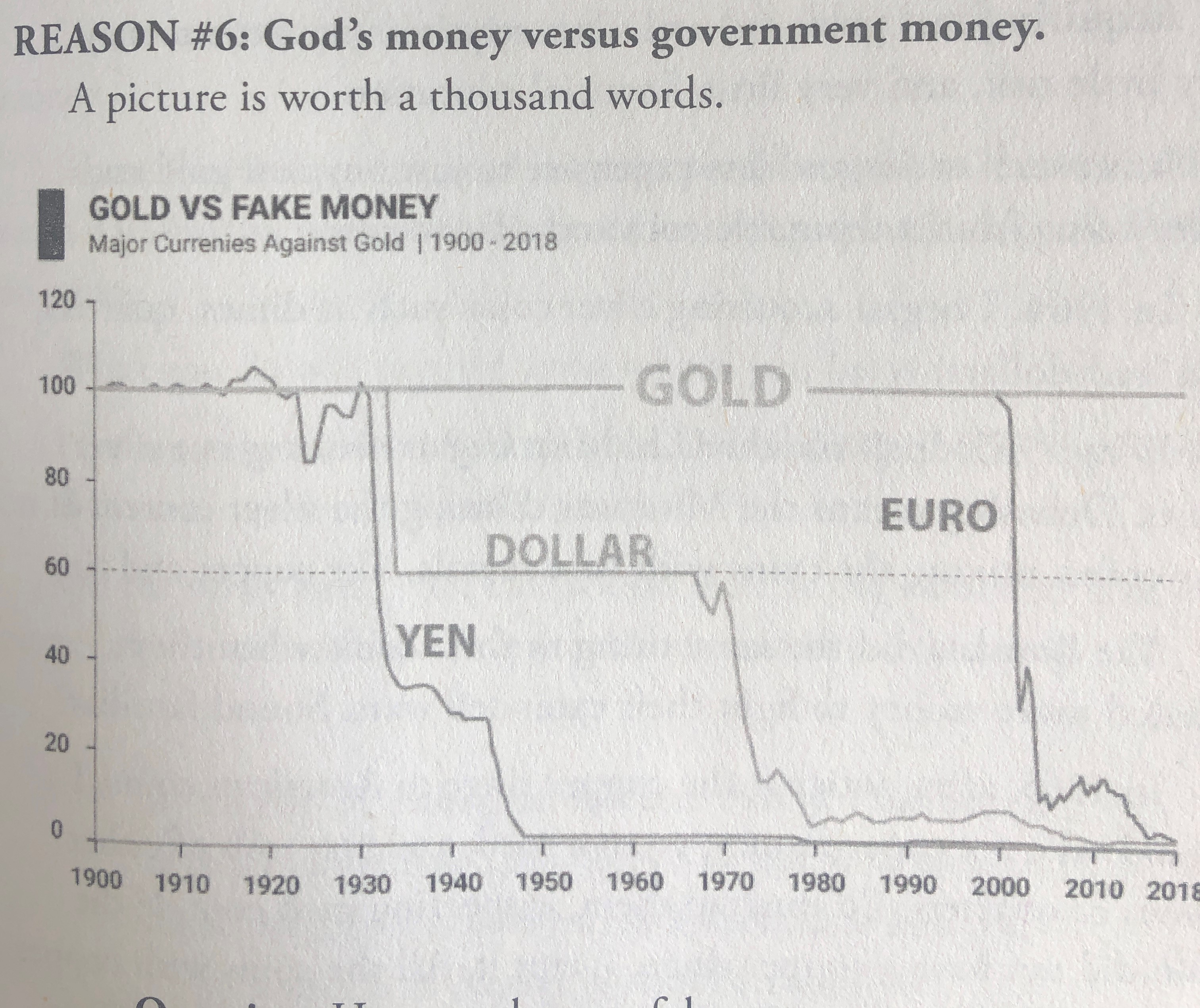

- Why gold and silver?

- Real gold and silver are not investments. They are insurance, a hedge against the stupidity of elites… and myself!

- No risk. Its value goes up and down because our fake money is going up and down. No counter party risk (default) too since the counter party here is God!

- Gold and silver attract real wealth. Wealth attracts wealth just as poverty attracts poverty. Spiritual angle to it on how you accumulate rather than how much

- I do not trust anything paper. Anything paper is a derivative, a fake, something that requires a counter-party to establish its value

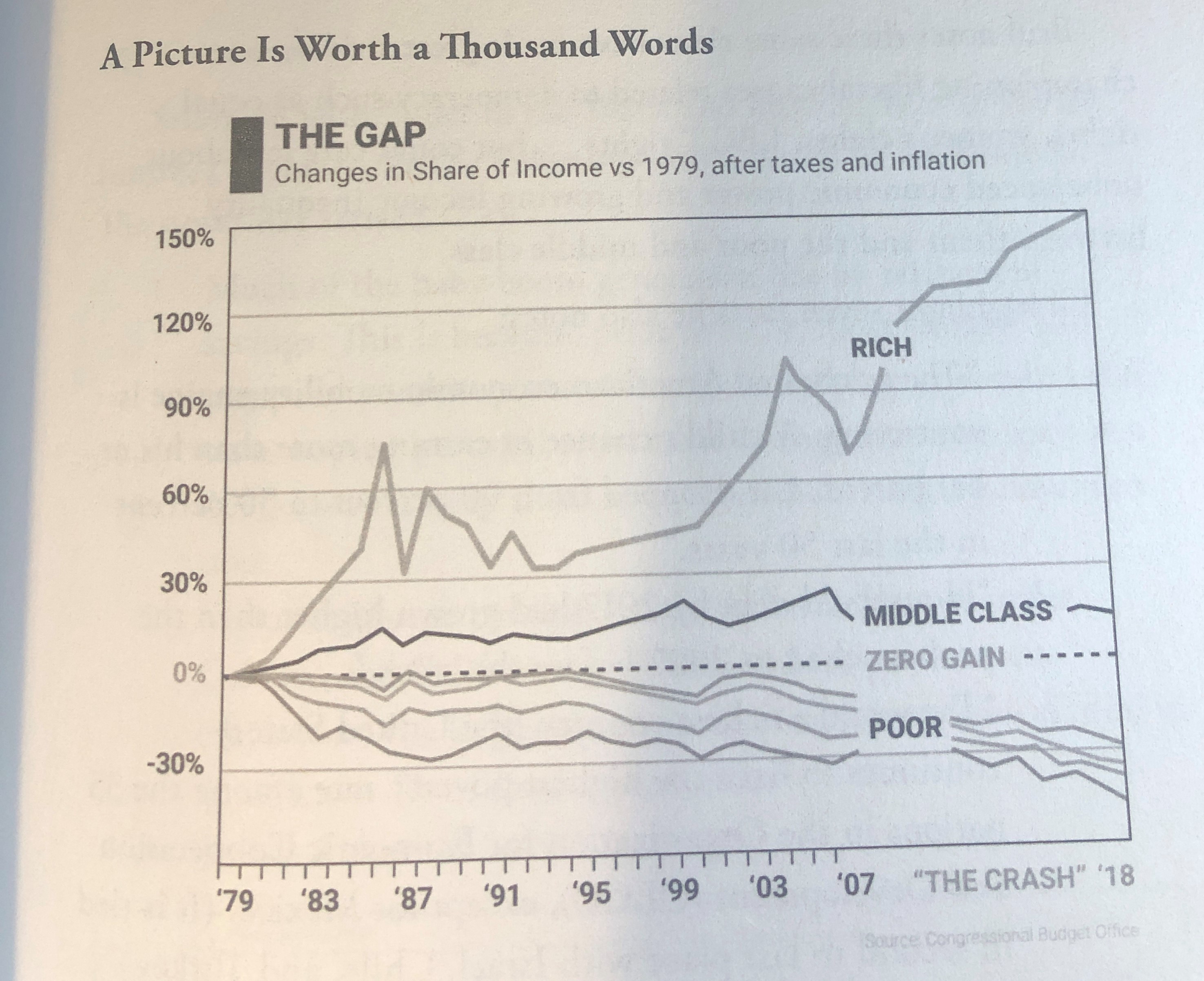

- The system is broke and broken (read more about it here in the words of Raghuram Rajan). The gap is growing and we are on the verge of class warfare

- Easy to understand and acquire

- A thousand years ago, money was not essential for living. Today, money is survival (food, shelter, transportation). People often say ‘I’m not interested in money’. Yet for most people, money squeezes the life out of their minds, bodies and soul

- People who work for money…. work for people who print money

- Cattle were used as collateral in earlier days. A synonym for collateral is security. In 2008 collateralised debt obligations (CDO) and mortgage backed securities (MBS) failed leading to a crash (since they had neither Collateral nor Security). Take notice of the word “collateralised” and “securities”. They represent the same purpose as cattle and were proven fake. Can you imagine a banker in those times not knowing what a real cow was? Yet, that is exactly what is going on today. You are basically printing money for the bank when you use your credit card or take loan. Whereas the bank prints money for you when you save

- Fractional reserve lets you print additional money as it lends out from the reserve you kept as savings. This cycle keeps on repeating without any solid collateral as 10 coins become 19 (you deposit 10, 1 is kept as security and 9 are further lent) and so on. This system is known as Mandrake Mechanism and is bound to collapse as mandrake has already pulled out a quadrillion dollars out of his hat during the 2008 crises but if all the savers line up to demand their money back in a crises, mandrake can pull out only so many (printing). Mandrake’s magic act can only survive if there is inflation. Deflation leads to debt becoming more expensive leading to depression

- The pessimist side has led me to prepare for the future with 5 Gs –

- Gold and silver

- Grub (food for 6 months)

- Gasoline

- Ground (property with water and food away from cities)

- Guns and ammo (they are both protection and currency)

- Real money by definition – Medium of exchange, Unit of account, Store of value (read fundamentals of money explained by a former RBI Governor)

- Prosperity has made many people soft, weak and lazy! Today, every child gets a trophy. Everyone is entitled. We have a split screen like mind. With duality of right and wrong, up and down, in and out, good and bad. The problem with dualistic, ego driven mind is that it never shuts up. Next level of evolution will require us to turn off our minds, shut up and tune into singularity (God). Westerners do not have the time or patience to meditate for 16 hours a day for 20 years in search of enlightenment. They want it faster and better and hence re-engineered courses on meditation. Asking for help is the first step in healing the pain all humans feel

- In the world of money, you cannot tell if a noun is an asset or a liability without verbs. A house can be an ‘asset’ or a ‘liability’ without the verb ‘flow’

- 6 words that are must for financial IQ –

- Income

- Expense

- Asset

- Liability

- Cash

- Flow

- In school, students are taught making mistakes make you stupid. In real life, making mistakes makes you richer (experience)

- Cheating means asking for help. Business and Investing are team sports!

- Your banker never asks for your CGPA or report card. They ask for your financial statement. It is crucial for everyone to make and understand their financial statement. Mostly with advisors the Magic does not happen because the name of the game financial planning companies play is not “Make Our Clients Rich”. The game is “Assets Under Management”

- School teaches to get out of debt. In real life, debt makes you richer

- Taxes are patriotic! In real life, the rich don’t pay taxes. (Some avg tax rates: Employee – 40%, Business – 20%, Self Employed – 60%, Investor – 0%)

- The test of first rate intelligence is the ability to hold 2 opposed ideas in the mind at the same time, and still retain the ability to function

- The more a person avoids financial risk the greater financial risk they take. Risk averse people fall into 4 categories –

- the worker (a risk averse person will have more jobs)

- the gambler (lottery)

- the student (take debt in a quasi religious belief in education)

- the criminal (start working for cash to avoid taxes)

- In the Information Age, because change and money are invisible, without real financial education, how can parents know what schools have (and have not) taught their children

- Being a taxpayer in a capitalist system Vs receiving welfare in a socialist system (Real Education Vs EBT). Which side would you rather be on? Tax and tax incentives are the engine of capitalism, not loopholes. Adding a capitalistic profit component to the non-profit adds a financial component socialism lacks: Financial Sustainability!

- Side effects of trade deficit – because the Chinese were accumulating so much cash and need a safe place to invest it, they dramatically increased demand for US treasury bonds. That pushed interest rates to unprecedented lows, which contributed to easy money being available to finance even the riskiest mortgages, and with them MBS and their derivatives

- Most government pension and social security plans are toast. Most of the time, politicians just ignore the problem and try to kick the cab down the road to the next administration. Occasionally they try to do something, voters then reject the plan or the union sues them!

- Today, most people are cautious about the food they put into their body. How many people are cautious about the information they put into their minds? The power of words – ‘I can’t afford it’ Vs ‘how can I afford it?’ ‘I’m not interested in money’ Vs ‘if you’re not interested in money, money is not interested in you’

- Threats to world economy –

- Rising interest rates (post crisis lowering offered cheap debt pushing the world into asset bubbles)

- China (debt to GDP ratio is highest. If China crashes, world crashes)

- Strong US dollar (US products will be costlier and it’ll be costlier for other countries to pay off US debt)

- Pensions (underfunded; read more here)

- While physical safety is important, the concept of safety has spread to safety from ideas that may disturb the student. In other words, emotional safety. This means free speech is dead. Making matters worse, if a student feels threatened by an idea, this new culture allows a person to retaliate, attack and even harm someone they have judged to have triggered uncomfortable emotions within the student

There are many doors to financial heaven. And even more doors to financial hell!

[…] How could any instant coffee – a universally sour, watery, and simply undrinkable liquid made from a combination of arabica and robusta beans – smell or taste even remotely like Starbucks rich dark roast? Starbucks finally cracked this code by making an instant coffee (VIA). This shows innovation and learning to conflicting thoughts is an important leadership trait (Read what Robert Kiyosaki says on the test of first rate intelligence here) […]

I precisely had to thank you so much again. I do not know the things I could possibly have done without the entire advice discussed by you about this topic. It truly was a very difficult scenario in my opinion, nevertheless seeing this expert way you managed the issue forced me to leap for happiness. Now i am grateful for the assistance and as well , have high hopes you are aware of a powerful job that you are putting in instructing others all through your webblog. More than likely you have never encountered all of us.