Poor Economics, written by Nobel Laureates (2019) Abhijit V Banerjee & Esther Duflo, is a book that tests the underlying assumption of Supply & Demand in economic theory by Randomised Control Trials (RCT). RCT is a type of scientific (often medical) experiment that aims to reduce certain sources of bias when testing the effectiveness of new treatments; this is accomplished by randomly allocating subjects to two or more groups, treating them differently, and then comparing them with respect to a measured response. Their recommendations are a result of a 18 country data set targeted to understand poverty and decision making of the poor. It tries to answer the questions on what the governments need to do in terms of resource allocation & why do poor behave the way they do?

Below is my interpretation of the book –

- This urge to reduce the poor to a set of clichés has been with us for as long as there has been poverty. The poor, appear in social theory as much as in literature, by turn lazy or enterprising, Noble or thievish, angry or passive, helpless or self-sufficient. The average poverty line in the fifty countries where most of the poor live is INR 16/day

- People are willing to donate money to an identifiable victim than when presented with general information at global scale. If presented this warning to people, they tend to think again that there’s no point of a drop in the bucket. Also, it is highly likely that the bucket leaks

- As Amartya Sen puts it, poverty is not just lack of money; it is not having the full capability to realise one’s full potential as a human being

Now this book busts myths around widely believed hypothesis and the commonly perceived solutions from a demand and supply perspective (they are economists; after all). Let us have a look at some of them:

- Hypothesis: Poor countries are poor because they are hot, infertile, malaria infested, often landlocked; this makes it hard for them to be productive without an initial large investment to help deal with endemic problems. But they cannot pay as they are poor. This is called a Poverty Trap.

-

- Solution: Aid. Foreign aid comes to the rescue here to kick start a virtuous cycle. The downside of aids is that it prevents from searching for their own solutions, while corrupting and undermining local institutions and creating a self-perpetuating lobby of aid agencies. People on this side bet on free markets and incentives

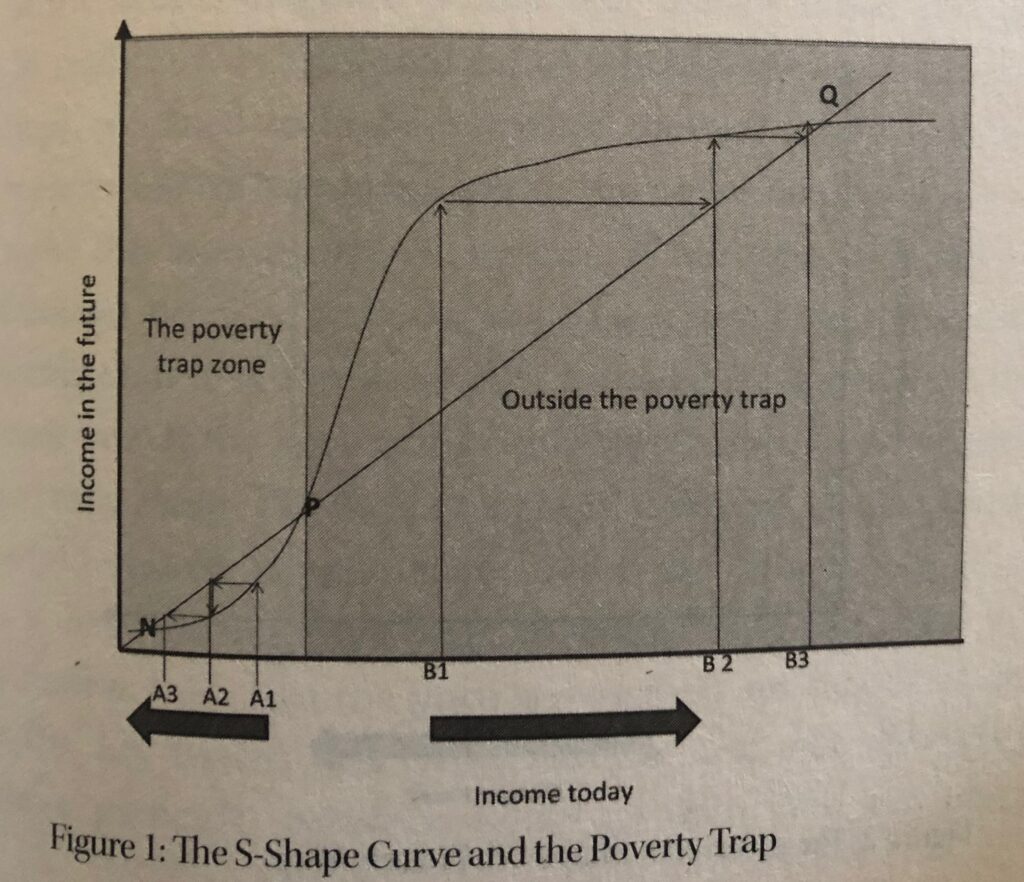

- There will be a poverty trap whenever the scope for growing income or wealth at a very fast rate is limited for those who have too little to invest, but expands dramatically for those who can invest a bit more. On the other hand, if the potential for fast growth is high among the poor, and then tapers off as one gets richer, there is no poverty trap. A conundrum! This is the S-Curve that, according to Abhijit & Esther, explains the human behaviour and growth:

- Hypothesis: Nutrition based poverty trap. The poor don’t get enough to eat! So what do we do? Subsidize food?

-

- Household that received subsidies for rice or wheat consumed less of those 2 items and more of shrimp and meat. Remarkably, overall, the caloric intake of those who received subsidy did not increase (May have even decreased), despite the fact that their purchasing power has increased. More calories were not a priority, better tasting ones was

- Nutrition based poverty trap is not entirely flawed. When resources are tight, it makes economic sense to sacrifice some people, so that the rest have enough food to be able to work and earn enough to survive

- Genetic height disparity goes off in 2 generations of south Asians in America if the nutrition is right. But is height really a problem? Yes, if you’re talking about the Olympic Games; also taller people tend to earn more (debatable but nutrition also led to smartness). Even in cricket the dominance like Australia and West Indies was never achieved by India

- Identifying the right calories may be beneficial for you as well as future generations. Yet, the ordinary human would sooner starve than live on brown bread and carrots. When you are unemployed, you don’t want to eat dull wholesome food. You want to eat something tasty (at least something in life must feel good)

- Basis the purchasing patterns, a Television is more important than food. And spend on festivals (weddings, pujas, etc)! This would explain why countries with a large domestic economy, where a lot of consumer goods are available cheaply, like India and Mexico, tend to be the countries where food spending is the lowest

- Hypothesis: Health based poverty trap. Malaria & Plague cause loss of life & productivity! So what do we do? Invest in awareness? Subsidize medication?

-

- Studies comparing high malaria prevalence regions in the country to low malaria prevalence regions find that life outcomes (such as education or earnings) of children born after the campaign in areas where malaria was once prevalent catch up with those of children born in low incidence areas. This suggests that the financial return to investing in malaria prevention can be fantastically high despite weak governance in these areas

- Most experts agree that access to piped water and sanitation can have a dramatic impact on health. This was responsible 75% for infant mortality reduction between 1900 -1946

- Nevertheless, the conventional wisdom is that today, at $20 per household per month, providing piped water and sanitation is too expensive for the budget of most developing countries. It was done at $4 in an Orissa village by Gram Vikas (NGO) – still not a priority for most governments!

- Basic other technologies like chlorine, ORS, getting children immunised, vaccine shots for child and would be mother, etc. the existence of these technologies is the source of Jeffrey Sachs optimism and his impatience. As he sees it, there are health based poverty traps, but there are also ladders we can give to the poor to help them escape these traps

- But demand for subsidised bed nets, chlorine, piping maintenance which even the poor can afford does not go up. The ladder to get out of a poverty trap exists but is not always in the right place, and people do not seem to know how to step into them or even want to do so

- The issue is not how much the poor spends on health, but what the money is spent on, which is often expensive cures rather than cheap prevention. Why?

- Absenteeism in government healthcare facilities (35% average and 43% in India)

- Unpredictability of the absence

- Even if services are there, people don’t use them. Why? Psychological sunk cost effect. People are more likely to use something they have paid a lot for. Since they haven’t paid, they don’t use. But this hypothesis failed in experiments!

- Faith

- Limited understanding of human body

- Attributing success of treatment to some medication rather than inaction (most flu cases, when the doctor suggests no medication, people are not satisfied, they want some action to be performed in order to believe it to be treatment)

- Time inconsistency – we think of present very differently than we think of future. In the present, we are impulsive, governed in large part by emotions and immediate desire. Any pain of standing in line for immunisation or petty discomfort feels much more unpleasant in present. Same thing happens with small rewards like candy or cigarettes. When thinking of future, these seem less important

- Hypothesis: Education based poverty trap. Hypothesis is if there is no demand for skill or education, children are not willing to go to school

-

- On the supply side, even if made free, absenteeism and quality remain a question

- The income increases only slightly in proportion to each year spent in school or higher education

- World over education systems are stressed. Enrolment has gone up faster than resources. People who would have otherwise opted teaching have started joining computer programming and bankers instead due to demand

- Technology in education is solving for little in rich developed countries as it competes with highly motivated teachers. But in developing countries, although adoption is sparse and low, results are much better. Children are able to set their own pace of learning.

- Hypothesis: Population based poverty trap

-

- Sanjay Gandhi May have unintentionally lead to a more rapid growth of population in the long run as the people felt free once his policy was over

- Drinking water is getting scarcer by the day as more people as drawing and drinking water. This also means more water is required for agricultural produce as 70% fresh water is accessed for irrigation

- Ethiopia, where total fertility rate is 6.12 children per woman, is fifty one times poorer than the US, where the total fertility rate is 2.05. The gift of the dying argues that epidemic of HIV AIDS will make future generation of Africa richer as fertility rates will reduce by reactance to unprotected sex and labour scarcity will make us attractive for women to work rather than have babies. But careful follow up rejects this claim as historically countries or regions with more people have grown faster. Are countries poor because of high fertility rates or do they have higher babies because they are poor? Did people get rich because of lower fertility or did they not have enough time to take care of more babies?

- Teenagers may be the most likely to have an unmet need for contraception, mainly because they are not allowed to access family planning services unless their parents give official consent and many countries fail to recognise the legitimacy of their sexual desires or assume they have so little control they won’t be able to use contraception properly

- Standard messaging to prevent this: Abstain, Be faithful, use a Condom… or you Die (ABCD). But studies indicate that adolescents make carefully calculated, if not fully informed, choices about whom to have sex with and under what conditions

- Girls still choose an older partner as it is more attractive option than doing nothing with no money. Older man may just take care of the family. Women make choices by learning from women in their own communities

- Hypothesis: Hight cost of capital; Lending: how much the poor repay on their daily working capital loan vs how much the rich pay in established business? In our 18 country data set, Less than 5% rural poor and less than 10% urban poor had loans from a bank. There is a huge void to be filled by micro finance institutions as the informal sector interest rates vary from 40-200% annually. The poor can come take credit at cheaper rates and come out of poverty. Why does this not happen? Is there a supply side issue?

-

- Government should not be in the business of subsidised lending. Apart from cost of risk or default, the cost of collecting relevant information about the borrower and the multiplier effect (as rates go up, borrower finds ways not to repay and this increases effort from the lender thereby pushing rates further up) are blockers in making these small loans to poor

- It is better to borrow from a known person and that is exactly what they do. Enforcing a contract requires the lender to be someone who can really hurt you. Even eunuchs were sent for recovery in India as seeing a eunuch genital was considered a sign of bad luck

- Although results in their tests were in the right direction as families started thinking about a future they wanted to have and worked towards it, there was no massive transformation in women’s lives or better education for children. MFI solved the supply problem by reducing flexibility as fixed cost would be recovered every week from a group. But this has caused demand side problem as people are not comfortable with this inflexibility

- Microcredit works as given a chance, it seems that people who had been hit by extreme hardship were able to take charge of their lives and start their exit out of extreme poverty

- The marginal return on investment tapers off. In a small grocery store, the inventory is low and even increasing inventory won’t help as people buy a single cigarette or shampoo sachet. It does not make sense to even sit there whole day. This is the paradox of the poor and their business! They are energetic and resourceful and manage to make a lot out of very little. But most of this energy is spent on businesses that are too small and utterly undifferentiated from the many others around them

- Hypothesis: The poor don’t save!

-

- Ever seen half built houses? Indeed, if the lack of self-control is sufficiently serious, it would be worth paying someone to force us to save!

- Some poor even buy fertiliser right after harvest rather than pre sowing (although there was an inconsistency in demand and supply that must be resolved) as it becomes a forced saving

- Awareness to our problems thus does not necessarily mean that they get solved. It may just mean that we are able to perfectly anticipate where we will fail

- Temptations are equal for the rich and the poor, it is just that the poor get badly affected by them (Read what Hitler had to say on poverty & the poor)

- Saving is less attractive for the poor, because for them the goal tends to be very far away, and they know there will be lots of temptations along the way. But of course, if they do not save they remain poor

- Policies and Politics – iron law of oligarchy: Bad institutions perpetuate bad institutions. Those who have power under the current political institutions get to make sure that the economic institutions work toward making them rich, and once they are rich enough they can use their wealth to forestall any attempts to move them out of power. Even if you outsource a country or a city and start it from the scratch with good institutions. The central problem is that it is easier to take over a country than to know how to make it run well. The disastrous effort of the USA to institute a market friendly democracy in Iraq is just one recent example

- The poor are like hedge fund managers – they live with huge amounts of risk. The only difference is in their level of income. No hedge fund manager is liable for 100% of his losses, unlike almost every small business owner and small farmer.

- Community network helping and borrowing can help as a local insurance. But this didn’t exactly happen. What stops people from doing more to help one another? Moral hazard – people may say they are in need when they are not. Or simply the promise of mutual help may not be carried through. Why not formal insurance? Moral hazard & Adverse selection (people who need it will only opt for it)

Proposed solutions do identify the loopholes in both Supply & Demand side issues but as they put it: Verifiable evidence is a chimera, at best a distant fantasy, at worst a distraction!