Enron, once the envy of all organizations on Wall Street, is a classic case of corporate governance gone wrong! This memoir written on the Enron scandal is something that all middle & senior managers must be aware of. All the events that lead to this debacle cannot be explained in this summary but in short, here’s what happened –

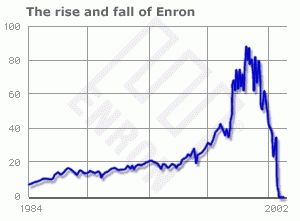

An ambitious guy (Ken Lay) met with a brilliant McKinsey consultant (Jeff Skilling) who gave this ambition a design that mesmerized everyone else. Enter into the equation a smart finance guy (Andy Fastow) who could structure & restructure any transaction till he was the only guy who could understand it (well within rules). Garnish this with auditors who got into the game but realized it was too late to get out and SEC that was caught napping! Bam! You get an organization that scaled all wall street peaks quarter on quarter making everyone involved so rich that they forgot it was a hollow business that would eventually go bust (see the stock chart)

Below is my interpretation of the book-

Who was Jeff Skilling?

- Jeff skilling was a designer of ditches, not a digger of ditches. His arrogance was that he was the smartest guy in the room and anyone who disagreed wasn’t simply bright enough to get it

- A McKinsey partner once told Forbes: “We don’t learn from clients. Their standards aren’t high enough. We learn from other McKinsey partners” (Read more about McKinsey in words of their ex-MD, Rajat Gupta, here)

What was the Enron Business model?

- Skilling saw patterns. By 1980s skilling was convinced he’d found an answer, nay, THE answer to gas pipeline industry. The Gas Bank! Interaction between the gas buyers and suppliers. Producers would contract to Enron. Consumers would contract from Enron. Everything in between is Enron’s. It spread the same model to multiple commodities like electricity, broadband etc. Free market deregulation was Enron’s solution to everything

- The old banker’s motto was: 3-6-3; take money at 3%, lend it out at 6%, and be on the golf course by 3pm!

- Enron had lower risk than a bank as it already knew what the price of gas was going to be (unlike a bank that assumes trends). It had already sold it. Their final trick up the sleeve: they started trading contracts. Derivatives!! Gosh. Skilling wanted a mark-to-market accounting rather than historical accounting (mark-to-market effectively meant realising future cash flows at NPV – irrespective that money came or not) (Read what Robert Kiyosaki has to say on Derivatives here)

What went wrong?

- Like any company that trades for a living – just like Lehman Brothers or Bear Stern seven years later – once Enron has lost the confidence of its trading partners, it was toast

- The performance review committee ranked managers on the same scale. The decision had to be unanimous. This led to horse trading (your guy for mine). Earnings were given Max weightage. All departments measured on earnings involved huge politics. Skilling thought it brought the best out of Enron:

- Rewarding brains

- Innovation

- Dedication

Many though it brought the worst:

-

- Ruthlessness

- Selfishness

- Greed

- Enron international booked cost incurred in making deals that were dead under assets as there was no official letter saying the deal was dead. They never thought anything could go wrong. So did the banks financing the deals. It was a Mania. Building projects in third world countries – often run by dictators – where capitalism was still a new concept was absolutely fraught with peril, and it was absurd to believe everything will go as per plan

- While investing in third world countries, companies bid and thought of making some quick profits by selling some pieces to other buyers when the project was underway. It all depended on the greater fool theory. Someone else was always ready to pay a higher price. It all started falling down when people stopped buying from Enron!

- The model of compensation was flawed. The developers got paid on present value of future cash flows even before a single pipe was laid. The only thing that mattered was getting the deal done. The problem was no one was held responsible for operation of the project, yet it was the operation that produced real money

- The Dabhol plant in India that made Enron controversial before bankruptcy. India’s energy sector was always run by state controlled boards on the verge of bankruptcy as so much energy was either stolen or given for free to farmers in a bureaucratic quagmire

- RAC (Risk Assessment and Control) department had the weakest leader who caved in to business demands. It was by design. At Enron there was virtually no consequence for cutting a bad deal

- Little attention was paid to customer relationships, Since nobody was going to get a big bonus for keeping customers happy

- Any company worth its salt uses accounting rules to smooth small peaks and valleys. But with Enron, it got to a point where it was so prolific. Budget shortfalls weren’t just business issues, they were accounting issues. There was absolute conviction at Enron that clever accounting could alter the business reality

Some anecdotes that elaborate the Enron culture

- Even before the dawning of the bull market in 1990s, a new ethos was gradually taking hold in corporate America – anything that wasn’t blatantly illegal was therefore okay. No matter how deceptive the practice was!

-

- Dog to Duck theory – If it is within the defined rules that a duck is an animal that has a body and can walk on ground and swim as well, Enron would make sure a Dog was portrayed as a Duck (since a dog also has a body that can walk on ground and can swim too)

- Journey of Enron – It was Zealotry to Greed to Arrogance to Demise

- No shots, No ducks. Nobody gets rewarded for saving money. They get rewarded for making money! People had difficulty believing they were even human as per an interview. Walking out of a posh office into a Limo going to the airport to fly a private jet made it really difficult!

- Easy money is rarely as easy as it looks

- You can’t build a company on brilliance alone. You need people who can come up with ideas, and you need people who can implement those ideas and are well compensated for doing so

- There were beggars long before they knew they were beggars

Great content! Super high-quality! Keep it up! 🙂

I am actually grateful to the owner of this site who has shared

this fantastic piece of writing at at this place.

P.S. If you have a minute, would love your feedback on my new website

re-design. You can find it by searching for «royal cbd» — no sweat if you

can’t.

Keep up the good work!

It is perfect time to make some plans for the future and it is time to be happy.

I have read this post and if I could I desire to suggest

you some interesting things or suggestions.

Perhaps you can write next articles referring to this article.

I want to read even more things about it!

Hi Willie

Surely would come up with more on this 🙂

Every weekend i used to go to see this web page, because i

wish for enjoyment, as this this web page conations truly fastidious

funny information too.

Asking questions are in fact pleasant thing if you are not understanding

anything fully, however this paragraph presents fastidious understanding even.

What’s up, every time i used to check webpage

posts here in the early hours in the dawn, for the reason that i like to gain knowledge of more

and more.

My husband and i were quite more than happy when Louis could round up his basic research with the ideas he gained when using the web page. It’s not at all simplistic just to choose to be handing out things which most people might have been trying to sell. We really remember we have got you to be grateful to for that. All the illustrations you made, the easy blog menu, the relationships your site help to create – it is all unbelievable, and it’s facilitating our son and us reason why that subject matter is awesome, which is quite vital. Thank you for everything!

I’m excited to find this website. I want to to

thank you for your time for this wonderful read!!

I definitely savored every little bit of it and i

also have you saved as a favorite to see new information in your

blog.